The 5 Factors That Impact Your FICO Score (and How to Improve Each One)

Introduction

Let’s get real for a second: your FICO score might seem like one of those mysterious numbers—like the secret formula for Coca-Cola or the agent in charge of Area 51. But unlike those secrets, your FICO score actually dictates if you get to buy that dream house, snag a new credit card, or—let’s be honest—finally stop sharing a Netflix account with your high school ex.

In personal finance, your FICO score is the VIP pass to low-interest loans, higher credit limits, and overall financial flexibility. Banks, landlords, and even some employers want to know how risky (or reliable) you are. With a higher score, you’re the financial equivalent of Tom Hanks: loved by all, first choice for any leading role.

In this post, we’ll break down the five key factors that make up your FICO score—and, more importantly, give you practical, no-nonsense tips to help you level up each one. Ready to hack your way to financial superstardom? Read on!

Understanding the FICO Score

What is a FICO Score?

Gather round the financial campfire, friends, for a tale of algorithms and ambition! The FICO score—which stands for Fair Isaac Corporation, the company behind the math—was first launched in 1989 to help lenders objectively evaluate how likely you are to repay borrowed money. Fast-forward a few decades, and it’s become the gold standard in lending decisions, underpinning over 90% of credit checks for major banks in the U.S.

When you apply for that car loan or mortgage, lenders consult your FICO score to decide not just IF you’ll get money, but HOW MUCH you’ll pay for it. Higher scores = better odds, lower interest rates, and fewer awkward conversations about your financial past.

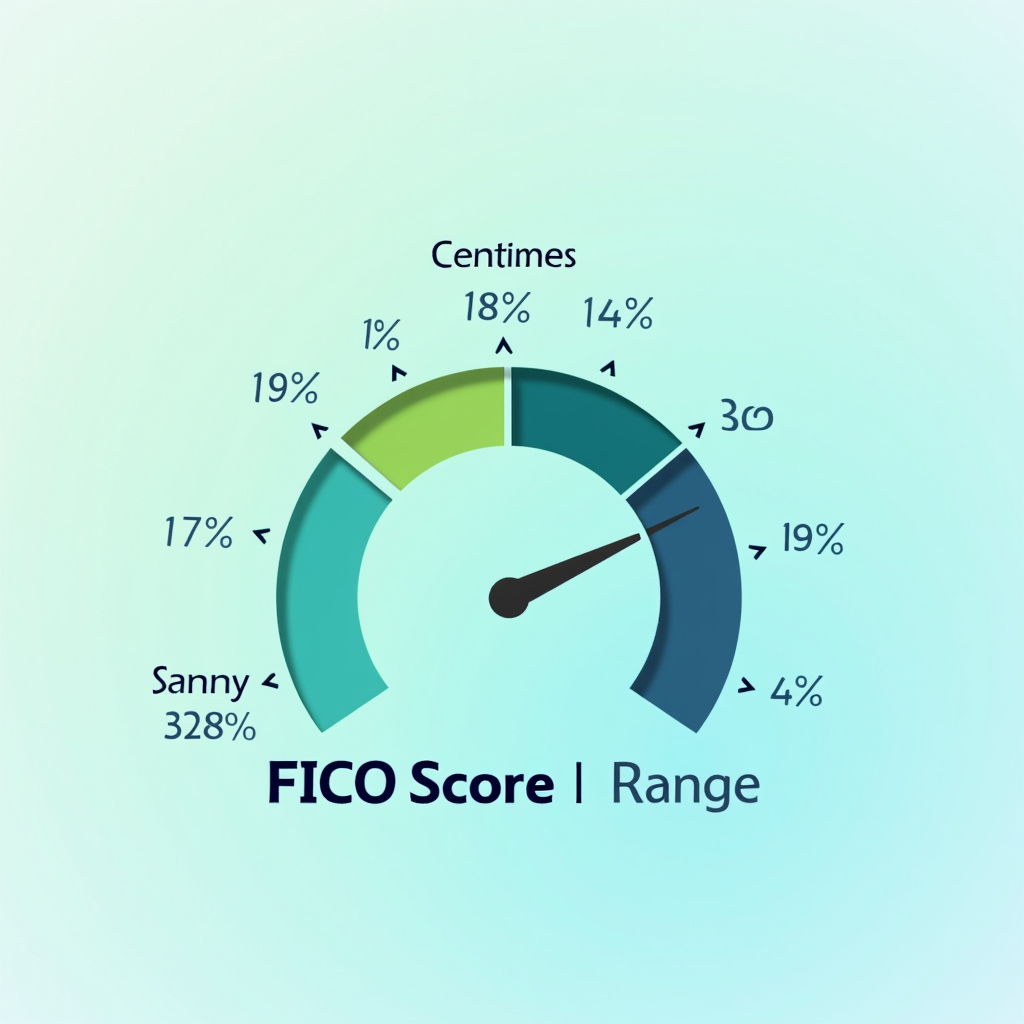

What Do FICO Scores Range From?

FICO scores run from 300 (yikes!) to 850 (financial unicorn). Here’s where things stack up:

- 300-579: Poor. (Not even your mom wants to lend you $20.)

- 580-669: Fair. (You could get credit, but not without some eyebrow-raising interest rates.)

- 670-739: Good. (You’re trustworthy—like a friend who returns borrowed books.)

- 740-799: Very good. (Banks fight over you. Drinks are “on the house” cool.)

- 800-850: Exceptional. (You get offers you didn’t even ask for. Did Beyoncé just ask about your credit advice?)

The 5 Factors that Impact Your FICO Score

Let’s play financial detective and investigate the ingredients of your credit score soup.

1. Payment History (35% Contribution)

Explanation

This is the Big Kahuna—the single most important factor. Lenders want to know: “Do you pay your bills on time, or are you the Houdini of utility payments?” Late payments, defaults, and bankruptcies are reported to credit bureaus and can haunt your score for up to seven years—kind of like that embarrassing photo from junior prom.

Improvement Tips

- Set up automatic payments for at least the minimum due. That way, you never “oops, I forgot!” your way into financial regret.

- Use calendar reminders for bills that can’t be auto-paid—turning your smartphone into a nagging but helpful friend.

- If you fall behind, prioritize high-interest debts to minimize damage, and reach out to creditors if you need to negotiate a payment plan or hardship option.

Want proof that late payments hurt? According to FICO, a single 30-day late payment can drop your score by over 100 points if you started in great shape. Ouch.

2. Amounts Owed (30% Contribution)

Explanation

FICO likes to see how much of your available credit you’re actually using—this is your credit utilization ratio. The higher the ratio (think: maxed-out cards), the more risky you appear. It’s not a crime to carry a balance, but keeping it low shows you’re not living permanently on the edge.

Improvement Tips

- Keep utilization under 30%. Got a $10,000 credit limit? Try not to owe more than $3,000 at any time.

- Pay down existing balances swiftly—the more you whittle down, the better you look.

- Avoid opening new lines of credit just to amp up your limits (unless it makes sense for your long-term strategy). Too many new accounts can sketch out lenders.

Feeling nosy? See your utilization by dividing your total credit card debt by your total credit limits. Less math, more money!

3. Length of Credit History (15% Contribution)

Explanation

Here’s where being a little older is actually a good thing. The longer you’ve had credit accounts—and the older your average account age—the more stable you look. FICO takes the age of your oldest and newest accounts, plus the average age, into account.

Improvement Tips

- Keep old accounts open, even if you don’t use them much. That ancient department store card from college? Dust it off and let it help your score.

- Avoid opening a bunch of new accounts at once. Each new account lowers your average, which temporarily ticks down your score.

Remember, patience isn’t just a virtue—it’s a literal score booster.

4. New Credit (10% Contribution)

Explanation

Each time you apply for new credit, a “hard inquiry” appears on your report. Too many inquiries in a short period looks, well, desperate. Not a look you want—unless your Halloween costume involves zombie-level panic.

- Hard inquiries: Result from actual credit applications and can lower your score for up to a year.

- Soft inquiries: Like pre-approved offers or your own checks—don’t affect your score.

Improvement Tips

- Limit new applications to when you genuinely need credit—not just because you got a sparkly mail offer.

- Research your options with online pre-qualification tools before applying to avoid unnecessary dings.

A burst of hard inquiries is fine if you’re rate shopping for a mortgage or car loan within a short window (usually 14-45 days counts as one inquiry), but otherwise—slow and steady wins the race.

5. Types of Credit in Use (10% Contribution)

Explanation

Lenders love “variety”—it shows you can responsibly juggle different financial responsibilities. This means having a mix of:

- Revolving accounts (credit cards)

- Installment loans (auto, student, mortgage)

Improvement Tips

- Consider diversifying credit only if it fits your financial plan. Don’t open an installment loan just for your score—interest payments are real.

- Manage your existing credit responsibly. Whether it’s a single mortgage or three cards and a student loan, pay on time and keep balances reasonable.

Monitoring and Managing Your FICO Score

The Importance of Regular Monitoring

You wouldn’t leave your health up to fate—so why your credit? Regular monitoring helps you catch problems, track improvements, and score early warnings of identity theft.

- Use apps and services like AnnualCreditReport.com (the only government-sanctioned site!) to get free yearly reports from each credit bureau.

- Many banks and credit cards offer free FICO or VantageScore tracking tools—take advantage!

Understanding Your Credit Report

Your credit report is like your financial report card. Spot errors, suspicious accounts, or an ex’s unpaid cable bill (awkward, but fixable!).

- Look for incorrect addresses, accounts you don’t recognize, or payments marked late that weren’t.

- If you find errors—dispute them quickly through the credit bureau’s website. Inaccuracies can drag your score (and your patience) down.

Conclusion

Your FICO score isn’t just a number—it’s the passport to your financial future. The five factors—Payment History (35%), Amounts Owed (30%), Length of Credit History (15%), New Credit (10%), and Types of Credit in Use (10%)—aren’t rocket science, but understanding and improving them can launch your finances to new heights.

Remember: being proactive is the name of the game. Set reminders, pay on time, keep balances low, maintain those old accounts (hello, ancient sock drawer card!), and mix up your credit types responsibly.

Ready to take control of your financial destiny? Start implementing these tips today—future you will thank you with a shiny new interest rate and a credit score that’s the envy of even your most responsible friend. You’ve got this. And if you ever get lost, just remember: your FICO score loves a little TLC… and maybe a side of spreadsheet nerdiness.

Stay savvy, stay curious, and may your credit be as robust as your morning coffee!